Heavy Oil Upgrading Overview

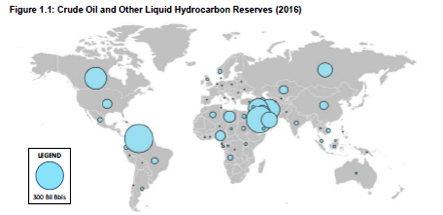

Optima is targeting the largest concentration of heavy oil in the world as one of its geographical targets

Optima has an MOU with Venro Petroleum Corporation, an international oil trader with substantial contacts with refiners throughout South America. South America has some of the world’s highest concentration of heavy oils, such as Venezuela’s Orinoco Heavy Oil Belt and Brazil’s offshore Campos Basin. Additionally, this geological formation includes the world’s largest oil reserves led by Venezuela’s 300 billion barrels (Saudi Arabia 266 billion), Brazil’s 13 billion barrels and Ecuador’s 8 billion. Optima sees enormous business potential from the combination of our MOUs with FluidOil and Venro Petroleum.

Source: Jacobs Consultancy, Source (EIA, 2017)

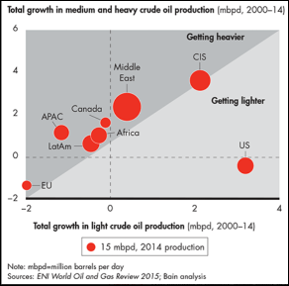

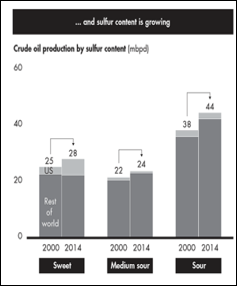

Worldwide crude feed stocks are becoming heavier.

Estimates vary for the size of the market for heavy oils/distillates. The International Energy Agency puts global refined heavy distillates at approximately 4.8-5.3 billion barrels/yr or some $250-300 billion/yr assuming crude prices between $50-60/bbl.

Outside of the USA, the crude slate is becoming increasingly heavy and sour (higher sulfur levels). To manage these crudes and capture the value the industry is looking at ways of ‘upgrading’ these heavier sour crudes and residuals to the lighter high value products which are increasingly required to meet environmental legislation.

Total Growth In Crude Oil Production

Sulfur Content Growth

Source: Bain & Company

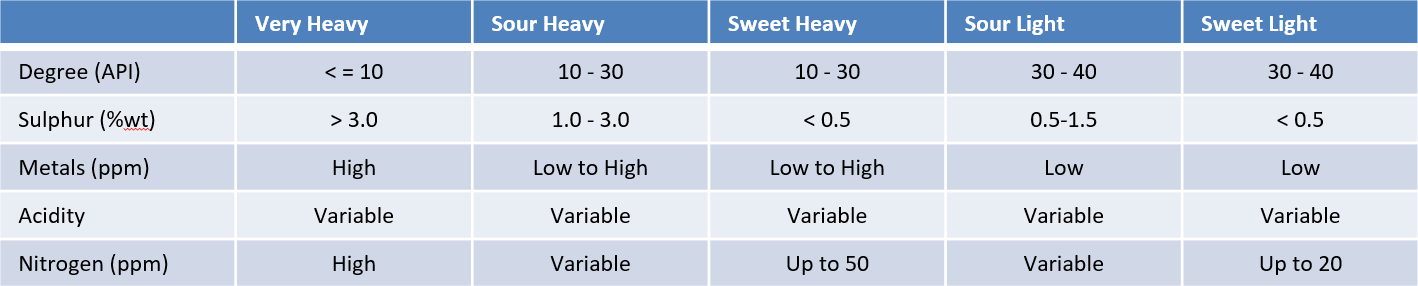

Heavier crudes are those that have a higher viscosity, measured in degrees API. Sour means higher sulfur content and environmental contaminants.

Sulfur Reduction

Sulfur reduction from refined products is key.

In addition to the crude slate outside of the US becoming heavier and more sour, most countries are now increasing the legislation to reduce sulfur in transport fuels:

- According to multiple industry reports, crude oil consumption will continue to increase with most growth in transportation fuels. Of this, most will come from emerging economies.

- The resulting increase in emissions from the growing demand for fuels is being countered by legislation that requires sulfur in transportation fuels to be reduced.

- The new low-sulfur rules affect both land and marine transport. In particular, IMO’s Global Sulfur Cap regulation will affect more than 50,000 ships worldwide by its implementation date of 2020.

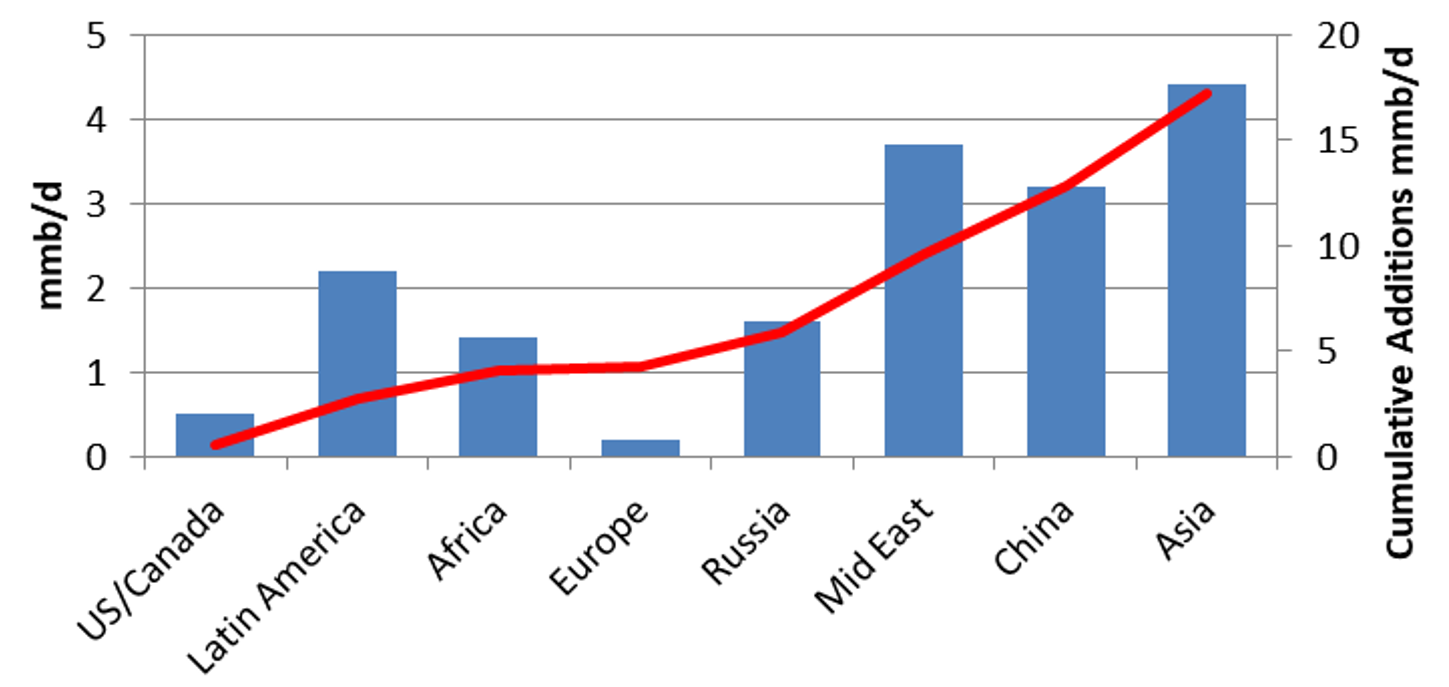

- Refiners have to respond and many predict that investment in 6.6 mmb/d of new desulfurisation capacity by the early 2020 and 17mmb/d by 2030. The majority of this capacity will be in non-OECD countries in the Asia-Pacific and Middle East regions.

Desulfurization Capacity Additions to 2030

(mmb/d)