Versatile process solutions from Optima

Skid Mounted Modular Process Systems

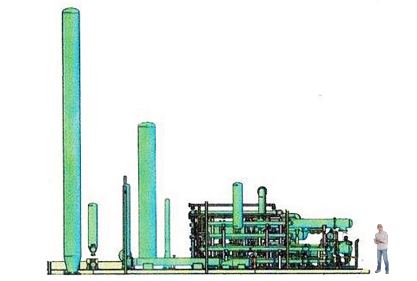

Optima has engaged with a company using advanced refining catalyst technology. This technology reduces production cost and energy usage thus reducing the overall environmental impact. The focus is initially on small skid mounted refinery solutions to speed delivery of our solution offering.

Example of modular / mini-refinery

Organic

- Farm waste to green diesel

- Wood to green diesel

- Hemp to CBD and other cannabinoids

Fossil fuel

- Used motor oils to specialty product

- Crude to marine fuel

- Efficient conversion of waxy crude to high value waxes

All of these potentially disruptive applications are at the pilot stage. Pre engineering work has been done with sites identified in most cases. What drives this wide range of products from such diverse feedstocks is the combination of the unique mini refinery design as well as the innovative metallic catalyst applied to feedstocks.

Heavy Oil Upgrading

Optima is engaged with two technology companies who have heavy oil upgrading technology. Both technologies are improvements on existing routes and help reduce carbon emissions

- Land Based: Upgrading opportunities exist which enable the development of stranded crude. “In situ” (at the wellhead) projects reduce or eliminate the diluent required significantly improving the economics.

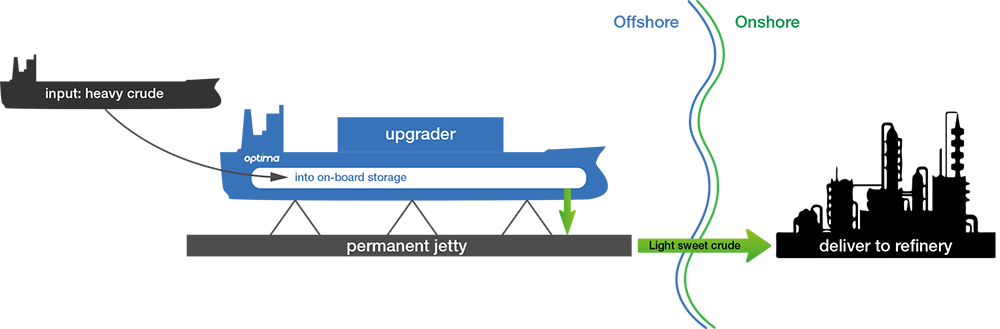

- Ship based: Optima is pursuing ship-based options for heavy oil upgrading. We have engaged leading shipping companies and are researching technology solutions which capitalize on the inherent benefits of low-cost tankage and utilities attendant with older ships.

Schematic of Optima’s ship-based system for small refineries particularly in the Mediterranean.

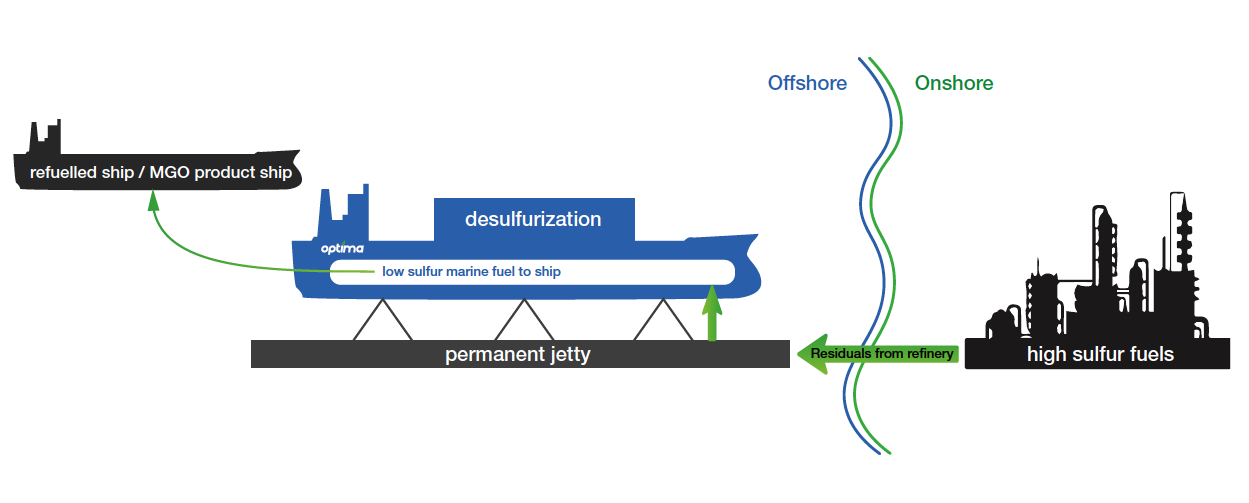

Desulfurization

Reducing sulfur is a key environmental issue. Optima is working with four companies with desulfurization technology. Two desulfurization technology companies offer novel low-cost solutions which operate at the temperature and pressure. These low-pressure low temperature processes are well suited for our ship-based Low Sulfur Fuel Oil strategy. One company’s refining technology removes over 90% of the sulfur and other contaminants. The other company reduces 50% of the sulfur and most of the contaminants in its upgrading process.

Schematic of Optima’s ship-based system.

Oil Field Wastewater Treatment

Wastewater and the cleanup of contaminated areas is an urgent and growing issue. Cleaning and handling the oily wastewater from the fracking industry is a critical issue. Optima has teamed up with two technology providers with innovative and rapidly executable solutions for wastewater cleanup and remediation of contaminated areas. Combined with either oil upgrading technology or small-scale refineries, Optima can provide a rapid, effective and low-cost solution to address environmental contamination from fracking and provide useful crude products like low sulfur diesel which reduce costs or create profits.

Oil Field Waste Remediation

Massive lakes of waste oil are one of the tragic environmental legacies of Big Oil, where Optima can provide environmental relief and reduce the cost or create profitable opportunities that are overlooked by large opportunities. These create great opportunities to improve prove the environment, convert waste oil into valuable crude products and test new technologies. We have an agreement with a waste oil remediation solution provider which in combination with our upgrading and portable refinery solutions, offer a tremendous opportunity to clean up the environment, make money and deploy new cleaner fossil fuel process technologies.

About IMO

Environmental legislation is requiring cleaner and less harmful transport fuel. Therefore refiners are needing to further process crude to meet these tougher specifications from this increasingly heavier higher sulfur crude slate.

In addition, the impact of the IMO’s MARPOL Annex VI environmental regulations on sulfur in global bunker fuels (HSFO) will cause a shift in global bunker demand away from HSFO to lower sulfur marine gas oil.

Marine Fuel Demand

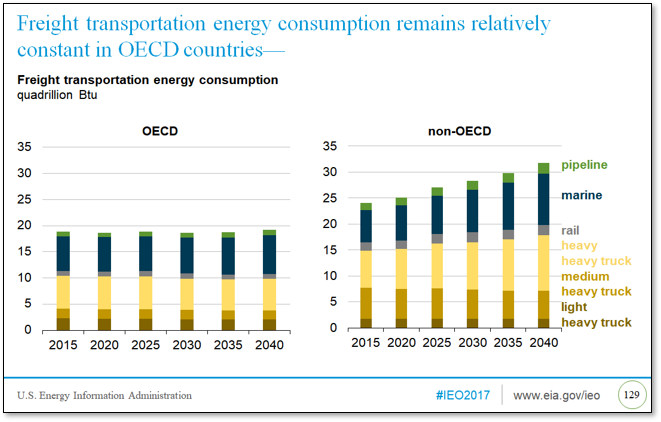

Marine fuel is set to increase as global GDP increases.

More than half of the increase in the world’s freight energy use is attributable to marine vessels. Residents in non-OECD countries continue to increase their demand for goods and services and producers become further integrated into global supply chains.

Residual Fuels Market

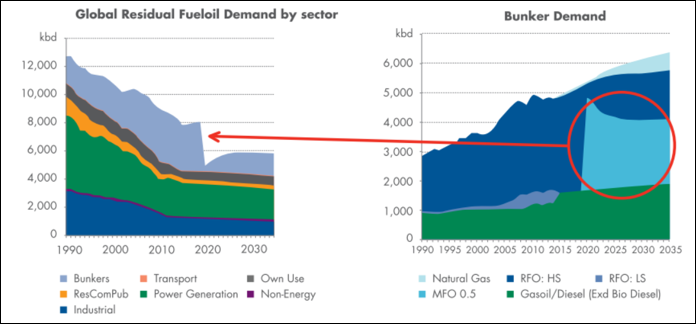

Bunker fuels are a large component of the residuals market.

The key focus of the residual market is on marine fuels:

- According to Shell, the residuals market is approximately 8 million b/d, of which the bunkers market is just under half

- Residual oil has been the fuel of choice within the bunkering sector; however, future IMO sulfur limits will lead to a significant reduction in consumption of residual fuels by the bunkering market

- Shell predicts that almost all residuals will switch from HSFO (residuals) to marine gas oil (MGO)after 2020, while the IEA predicts 2 mmb/d.

International environmental regulations are driving refiners to upgrade their refineries to meet the increasingly stringent fuel specifications

The 2015 United Nations Climate Change Conference in Paris (COP21).

- This set the stage for future energy consumption. Almost the entire international community agreed to “hold the increase in the global average temperature to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C above pre-industrial levels”

- This is driving countries to adopt ever more stringent fuel specifications to reduce levels of harmful exhaust emissions. This includes nitrogen oxide (NOx), carbon monoxide (CO), hydrocarbons (THC and NMHC) and particulate matter (PM), meaning soot from diesel vehicles. The knock-on effect of reducing these pollutants can also mean improved fuel economy and lower CO2 emissions.

The International Maritime Organization (IMO) and its International Convention for the Prevention of Pollution from Ships (MARPOL) (MARPOL Annex VI)

- The IMO announced that the effective date for the reduction of marine fuel sulphur will be 2020. Under the new global cap, ships will have to use marine fuels with a sulphur content of no more than 0.5% sulfur compared with the current limit of 3.5%S in an effort to reduce greenhouse gas emissions. The Emission Control Areas (ECAs) will remain at the 2015 standard of 0.1%S content.

- The impact of the IMO’s MARPOL Annex VI environmental regulations on sulfur in global bunker fuels (HSFO) will cause a shift in global bunker demand away from HSFO to lower sulfur marine gas oil (MGO). The EIA put this new demand at 2millionb/d. Shippers have 2 options,

- either fit exhaust clean up equipment to their vessels which is very expensive

- or pay the higher price for the cleaner fuel.

- Most commentators believe shippers will take the latter option to save upfront cost.