Frequently Asked Questions

Where is the greatest opportunity?

The surprising benefit of oil’s bear market and the ESG divestiture phenomenon is that oil assets are at historically attractive valuations. The lack of fossil fuel sector funding is leading to consolidation and turnover in the sector. This makes natural resource, IP, corporate executive talent available on compelling terms. Optima’s ability to identify attractive technologies and compelling projects which offer environmental benefits and attractive cashflow is our greatest opportunity. Optima is at the right place at the right time.

How did Optima start?

Robert Gibbs and Tyson Halsey, CFA initially considered the idea back in 2017. Halsey had been a large shareholder in a development stage Canadian heavy oil upgrading company that as a result of mismanagement did not deliver on its potential. Through Halsey’s efforts to help the upgrading company, Halsey connected with Gibbs, an engineer, project manager and corporate finance strategist, with an impressive 60 year career in energy.

In early 2018, Halsey met with Gibbs and Len Cozzolino, a long-term associate of Gibbs, to discuss a corporate strategy and together developed the idea of a ship-based heavy oil upgrader. Halsey retained Gibbs and Cozzolino, as consultants, to draw up an initial market analysis. That study highlighted the urgent desulfurization market requirements of the International Maritime Organization environmental regulation–IMO 2020. In August 2018, Optima Process Systems issued stock under Regulation D seeking to develop a ship-based desulfurization strategy and a ship-based upgrading strategy.

These efforts and Optima’s technical research introduced some other promising technologies and business opportunities including land based upgrading, modular portable refining, oil field wastewater and waste oil remediation and treatment. Optima’s efforts have increasingly focused on sustainable technologies broadening the technology opportunity set to combat climate change and pollution.

Does Optima have any Intellectual Property?

Optima does not have any intellectual property in its portfolio. While this may seem disconcerting, oil refineries themselves do not have intellectual property, but use a variety of licenses from varied companies often sub-licensed from large engineering, procurement and construction companies. However, Optima has entered into agreements with its technology partners for its IP under terms and conditions.

Optima benefits from is its broad industry knowledge to identify compelling use of a technology. Its engineering expertise helps Optima to understand the comparative advantages of competing technologies in energy. The company has the banking skills and access to capital to fund projects when those projects are third party confirmed.

How close are you to starting your first project, generating revenues or earning money?

Optima is working with four primary technology companies and evaluating several potential projects. It is looking to start a 1,000bpd heavy oil upgrading pilot plant using a processing technology that is 60% cheaper than conventional upgraders in Central South America with an exploration and production company run by an oil services PhD.

Optima is also evaluating three cost effective skid mounted portable modular processing applications utilizing a novel metallic catalyst for:

- renewable applications including timber to green diesel and farm waste to green diesel.

- hemp to cannabidiol (CBD) used to treat pain, insomnia, and anxiety

- conversion of waxy crude to high value specialty products, wastewater residual conversion to low sulfur diesel, used lube oil conversion to low sulfur diesel, crude oil to low sulfur marine fuel.

The company remains engaged with two different desulfurization technology companies to use in a ship-based solution which continues to project compelling economics; however, neither companies technology is commercially proven at this moment in time.

There is also activity into using its modular portable refinery strategy in combination with oil field wastewater to provide an attractive cash generating sub-unit within the wastewater treatment projects in fracking in Texas and the United States.

Is Optima Process Systems, Inc. publicly traded or raising capital?

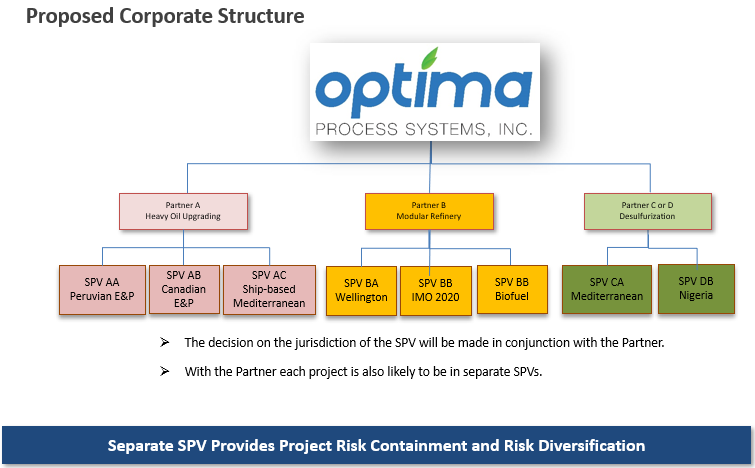

No, Optima Process Systems, Inc. is not publicly traded, but is a Delaware C-Corporation through a Regulation D Filing. Optima raises capital from time to time. Such offers can only be made through legal offering documents and subscriptions agreements. Optima will use Special Purpose Vehicles (“SPVs”) to fund specific projects. Each project will operate as a separate business with segregated bank accounts. This allows Optima to offer a range of projects and technologies while diversifying and limiting the project specific risk to the SPV. Investors in Optima, the parent, will have a more diversified risk profile than a funder in a specific project.

The likely structure of the SPV will be through the issuance of a preferred stock offering under Optima’s Regulation D Filing in Delaware.

What can be said about the team?

The skill set of the team is extraordinary. Raphael Rojas founded an international oil, gas and trading company building on his 50 years experience in the oil industry commencing as the top salesman of crude oil from PDVSA to the United states and working as a petroleum engineer for Exxon. As CEO of Venro Petroleum, Rojas is active in the production of 11,000 BPD of oil in Venezuela and owns oil and gas properties in several state in the United States. It is here in the US where Optima is working with Venro Petroleum to leverage its expertise in energy transition tax credits and artificial intelligence to streamline its assets and operations.

Neil Winward is an advisor to Optima. Winward is the founding Partner of Dakota Ridge Capital has a track record of sourcing and structuring renewable energy transactions to meet the needs of a range of investment appetites in this fast-growing energy transition space. Winward seeks to leverage The Inflation Reduction Act (IRA) to drive the energy transition. The IRA has opened up new investment asset classes – biofuels, carbon capture, hydrogen, nuclear – and has paved the way for an entirely new set of investors – tax exempts – to participate and monetize the host of incentives previously available only to tax payers.

Milos Mitch Bulajic is an advisor to Optima. As the Chief Strategy Officer (CSO) and board member at Elastacloud, a Gen AI engineering firm, Bulajic brings over 30 years of expertise in finance and business leadership to drive the company’s mission of transforming data into actionable insights. His role involves comprehensive financial analysis, strategic planning, and the integration of market and business intelligence with Gen AI solutions. Bulajic specializes in corporate finance, market intelligence, investment banking, and Gen AI engineering. This diverse skill set enables him to uncover new business opportunities, optimize resource allocation, and effectively manage risks. Mitch’s strategic initiatives have consistently delivered over 30% business growth, aligning financial strategies with his organizational goals.

Peter Veillon is an advisor to Optima. Veillon currently serves as Managing Director at Realcap Strategies, LLC, a private investment firm charged with the oversight of operating companies and real asset investments of a multi-generational, single family office. Prior to joining the group, he spent a number of years in private equity, investing in energy and power and prior to this in manufacturing and business services. He began his post-graduate career investment banking at Bank of America Securities in the Natural Resources Group. Prior to his career in finance, Veillon worked for multinational companies in the energy and natural resource sectors. Veillon is a graduate of Queen’s University at Kingston where he received his BSc in engineering and received his MBA from the Ivey Business School at the University of Western Ontario.

Harry Edelson, CFA, CCP, CDP, is an advisor to Optima. Edelson is a renowned venture capitalist and general partner of Edelson Technology Partners. He brings considerable experience to the Optima team, having served on the boards of directors of more than 150 companies and is published on corporate governance. Edelson has played a role in numerous mergers and acquisitions during his venture capital career. He is not an energy investor but became interested in Optima and its IMO 2020 pursuit and provides valuable business advice based on his impressive career. You can read more on Edelson at Edelson Technology Partners.

Rafael H. Rojas is an advisor to Optima. Rojas is the president and chief executive officer of Venro Petroleum Corp., based in New York City, which markets and supplies crude oil and gas to clients around the world. Through Venro, Rojas owns numerous wells and oil fields throughout North America. Responsible for wells in the Marcellus Shale field in Pennsylvania, his companies produce 7,000 b/d of oil. His Ohio holdings include mineral rights and wells across 5,000 acres and he has extensive contacts with South American refiners and trades their heavy crude oils.

Tyson Halsey, CFA, is Optima’s President. Halsey has worked in the investment industry as a broker, investor, investment advisor and hedge fund manager in technology, biotechnology and energy for 35 years. For the last 17 years, he has been focused on midstream energy master limited partnerships. Halsey has been an activist investor advocating for shareholder rights and value and has been cited in Barron’s and the Wall Street Journal. Halsey publishes on Seeking Alpha and been a guest on CNBC after winning the USA Today CNBC National Investment Challenge. Halsey is a market valuation analyst and student of market cycles and psychology. While working in NYC from 1983 to 2008 and throughout his career, Halsey has developed a network of leading investment professionals.