The upcoming IMO 2020 rule will give sophisticated refiners a license to print money.

Global fossil fuel refining is a $2.5 trillion industry. Despite the success of alternative fuels and green technologies, it is estimated that fossil fuel refining will grow by 50% by 2050.

Cumulatively, this is a $99 trillion industry that will need to become environmentally compliant, optimized and sustainable. Optima’s innovative ship-based solutions provide meaningful economic and logistical benefits to both the refining and shipping industries and is positioned to play a role in the world’s energy transformation.

Optima ship-based desulfurization and heavy oil upgrading solutions are gaining traction and validation from leading global shipping companies, process companies, traders and private equity investors. While our ship-based solutions are still in the prototype stage, two of the largest shipbrokers in the world are keen to work with us to commercialize this strategy.

We have engaged several desulfurization and upgrading processes companies and are negotiating memorandum of understandings (MOU) for use of their technologies. We are not interested in developing new technologies. Rather we are looking at processes that can operate efficiently and effectively on a ship and provide turnkey solutions to refineries. Optima’s ship-based model helps technology providers enter the market faster and can expand their markets as floating desulfurization and upgrading processes are a novel application.

Industry experts note that ship-based or floating processes have been used elsewhere in the energy sector quite efficiently. Our strategy is not dissimilar to other ship-shaped solutions, such as offshore power generation; floating LNG; floating storage and regasification (FSRU), et al. Essentially, Optima brings a low capital-intensive technical solution to bear without involving planning permission, building a new facility and hiring additional staff. Two members of our management team, Robert Gibbs and Len Cozzolino, have successfully designed and built ship-based processes, which provides us with experience that makes Optima well suited to execute this innovative application.

The International Maritime Organization’s “IMO 2020” environmental regulation is a major driver for our ship-based desulfurization solution. In spite of efforts to postpone the marine fuel regulation, IMO 2020 will go into effect on January 1, 2020. While 20% of ships will use scrubbers to address IMO 2020, such a solution will have a multi-million price tag, added maintenance and space usage issues which argue against their implementation. Consequently, most shippers will look to refiners to produce low sulfur bunker fuel and pay the high cost of supply constrained low sulfur MGO next year.

There are about 700 refineries globally of which half produce 100,000 BPD or less. Large refineries, often owned by the international and national oil companies, cost on the order of $40 billion for which retooling for optimization and eco-compliance can cost each $10 billion. The smaller 350 independent refineries lack the financial capacity for refinery retooling. Herein lies Optima’s market. Our low-cost turnkey ship-based solutions will provide processes for smaller refineries whose residual streams will drop in value due to their high sulfur content and will struggle with the capital requirement of eco-compliant solutions.

Large refiners would be happy to have competition from these smaller refineries taken out of the market. Earlier this year, the Trump administration sought to delay IMO 2020 to mitigate higher oil prices, but the effort was quashed because oil industry trade groups argued against the proposed rule delay. Why? The large oil companies will happily reap the benefits of the wider spreads created by the shortage of low sulfur bunker fuel, while simultaneously watching their competitors disappear under more stringent global environmental regulations.

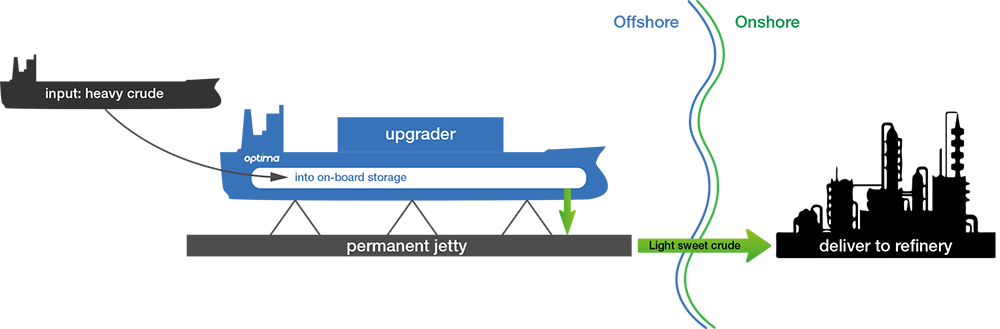

Optima is also focusing on another major market. Though not as urgent as desulfurization, the $350 billion heavy oil upgrading sector helps refiners address the shifting availabilities of light and heavy crudes globally. An ironic consequence of the US fracking boom is that the US produces so much light sweet crude that such feedstock is no longer being imported. Since many US refineries were designed for a heavier crude, refiners here must now import heavy crude oil to avoid spending hundreds of millions to reoptimize their refineries for the sweeter domestic feedstock diet.

Optima is working with an international oil trader with significant South American refinery access. As South America has the greatest concentration of heavy crude oil in the world, we are evaluating using our systems to upgrade South American heavy crude and ship that product to the US in Jones Act compliant ships.

If you or your company are interested in participating in this new venture – i.e.looking to invest or provide a maritime or processing technology – please get in touch, in the first instance, with Tyson Halsey ([email protected])

Large refiners would be happy to have competition from these smaller refineries taken out of the market. Earlier this year, the Trump administration sought to delay IMO 2020 to mitigate higher oil prices, but the effort was quashed because oil industry trade groups argued against the proposed rule delay. Why? The large oil companies will happily reap the benefits of the wider spreads created by the shortage of low sulfur bunker fuel, while simultaneously watching their competitors disappear under more stringent global environmental regulations.

Optima is also focusing on another major market. Though not as urgent as desulfurization, the $350 billion heavy oil upgrading sector helps refiners address the shifting availabilities of light and heavy crudes globally. An ironic consequence of the US fracking boom is that the US produces so much light sweet crude that such feedstock is no longer being imported. Since many US refineries were designed for a heavier crude, refiners here must now import heavy crude oil to avoid spending hundreds of millions to reoptimize their refineries for the sweeter domestic feedstock diet.