The energy industry is at a crossroads.

The world and global energy markets must address the massive environmental challenge of pollution and global warming. Optima Process Systems, Inc., which offers innovative low-cost solutions to reduce the environmental impact of transport fuels, is helping to develop practical technologies and solutions to address this challenge.

Fossil fuels and oil, in particular, have been highly efficient energy sources since 1850. Fossil fuels have played a major role in the growth, industrialization and modernization of the global economy. However, like coal, Big Oil’s legacy of pollution, environmental damage from its exploration and development and its impact on global warming have created an epoch problem.

Optima’s Commercial Prospects:

Optima has engaged with four different technology providers with proven technologies. Optima has identified several pilot projects which can reduce the toxic emissions from transport fuels and improve process efficiency. Costing between $3,000,000 to $10,000,000, these pilot projects test the commercial viability of these new cleaner low-cost technology based solutions. Not only do these projects look viable, they appear to be highly profitable. Two of the projects could generate revenues and earnings in 2020.

Optima’s four technologies include:

- a heavy oil upgrader which converts thick heavy oil into flowing synthetic crude with 50% of the sulfur and 90% of the metals removed.

- a novel metallic catalyst used in an innovative skid mounted mini refinery. The process removes over 90% of the contaminants, including sulfur and metals.

- Of major significance, this process also works on organic products such as farm waste to make green diesel. This is an extremely attractive environmentally positive opportunity which we are exploring.

Two are desulfurization technologies:

- One comes from a well-funded organization using a sodium ceramic process. Unfortunately, the technology will not be commercially ready for two years.

- the second is a hydrogenation catalyst process that was honorably mentioned in a Platts new technology review.

- $3 million would fund refinery residual desulfurization pilot project.

Some of our technology partners need development capital. This provides Optima the opportunity to make strategic investments in these potentially disruptive technology providers.

Fortunately, some of the technologies Optima is considering are still below the radar. We’ve been asked “Why doesn’t Big Oil do what you are doing if it is so smart?” The answer is analogous to the situation between pharmaceutical companies and biotechnology companies. In the bio-pharmaceutical paradigm, for example, there are exciting immune oncology drugs which promise to cure cancer, but the pharmaceutical industry does not invest because the time and money to develop these technologies is prohibitive. It can cost over one billion dollars and takes years to bring a new drug to the market. Consequently, a pharmaceutical company will wait until a phase three clinical trial has produced a statistically significant outcome or the FDA has approved a new drug. Then, a pharmaceutical company will step in and buy the biotech company at a huge premium.

Optima has four actionable pilot projects for review. We are exploring other opportunities and drilling down on actionable projects. With the South American E&P, we have run computer simulations on the crude assay for target location. With another project, we have reviewed their data room, supply contracts, offtake agreements and are confirming product pricings for another.

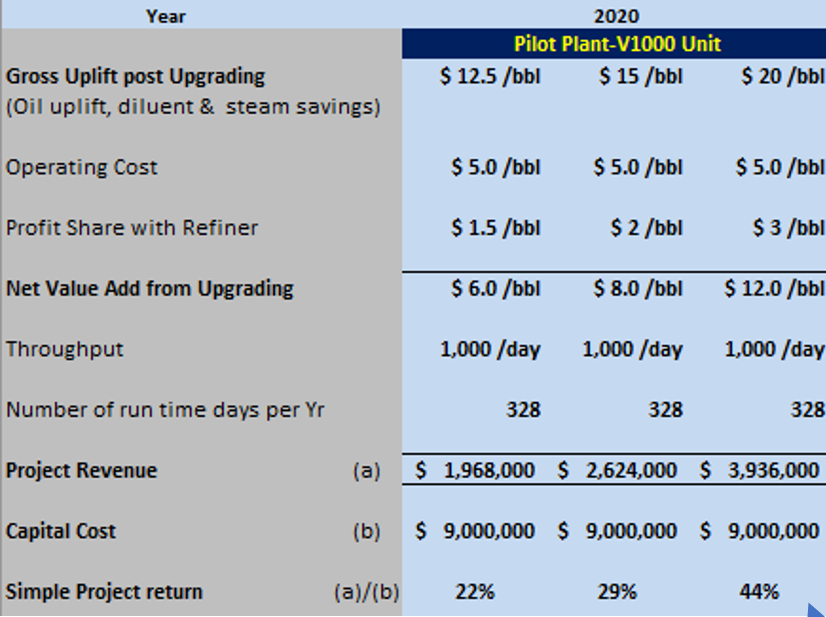

Potential Pilot Project Returns 22-44% in the first year.

This sample upgrading pilot test should cost $9,000,000. Its process is:

- 60% less expensive than conventional upgraders.

- Reduces sulfur by 50% and metals by 90%

- Developed by industry. leaders spending over $100 million.

- Ideally deployed in situ where costly use of diluent can be eliminated.

- We have computer simulated upgrade results on feedstock provided by a Peruvian E&P.

- Several additional locations are being considered.

The model above shows a 1000 BPD pilot project profitability could quickly cover the initial $9,000,000 investment. We also estimate, if the project is scaled to 46,000 BPD by adding a 5000 BPD and two 20,000 BPD units, the total cost would be $245,000,000 and earn $120,000,000-$211,000,000 per year. (The spread reflects the variance between $12.5 and $20/bl value add.)

To realize a higher $12 to $20 BPD net value add or “Gross Uplift post Upgrading”, the unit should be located at a site where it is replacing the use of diluent where a significant economic benefit is created in addition to the value enhancement in the oil.

Before construction, a specific site must be located, complete engineering estimates must be run, and then the results must meet or exceed estimates.

Optima is in the Right Place at the Right Time:

“When there is change, there is opportunity.” The intersection of the environmental problems from fossil fuels and massive global energy needs has created institutional momentum to innovate energy technology and transform consumption behaviors so that the earth and its people do not poison the environment while simultaneously lifting three billion people out of poverty.

Optima’s timing is also fortuitous in that the energy sector has suffered a long and deep decline leading to historically attractive asset prices. In both the public and private energy markets, assets can be bought with high yields (from 5% to 15%), which, in a world with historically low interest rates, means that new money will invest in those assets that are not subjected to Environment Social and Governance “ESG” divestitures or restrictions. Those institutions and individuals who invest in energy, especially those that are part of the environmental solution, will enjoy this tailwind for years.

The bottom in the energy sector:

- In the last decade, the S&P Energy Sector has returned 5% versus the S&P Technology Sector which returned 333%.

- The Energy Sector has declined from 20% of the S&P 500’s total capitalization to 4%.

- The market capitalization of the S&P 500’s Energy Sector of the is $1.2 trillion, less than Apple Inc.’s $1.39 trillion market capitalization.

- December’s public offering of Saudi Aramco, with a market capitalization of $1.7 trillion dollars, may also signal a sector bottom and mark the completion of an unprecedented energy asset sales cycle.

Optima conducts due diligence on new process technology companies and the energy technology sector. This research gives Optima insight not easily be gleaned by competitors. Many of these technologies are currently going through testing and development milestones to assess their commercial potential. This can provide unusual opportunity.

In 1992, the author won the USA Today CNBC National Investment Challenge with a quarterly return of 1087%. The experience illustrated the benefit of rigorous diligence on biotech companies before they announced their clinical trial results. During the contest, the author made three option trades around critical clinical trial outcomes. At that time, I was working closely with my desk partner—(Michael King, now a professional biotechnology analyst), several researchers, consultants and doctor-clients. We made some well-timed investments gearing off minutia and scuttlebutt which was below the radar of the general public. The subsequent valuation changes to these companies were enormous. Today, Optima is in a similar position to leverage process development milestones to the benefit of our investors and technology business partners.

Optima’s due diligence is aided by an extraordinary group of advisors who are stock option holders. In addition to Robert Gibbs and Len Cozzolino’s 100 years of oil and engineering experience, we have: a former cohead of energy M&A from Citicorp; a Canadian energy engineer and investment banker with energy private equity experience; a former Koch Brothers and Marathon Oil employee and refinery and chemical research analyst; a chemistry PhD with a long career in upgrading engineering.… and Harry Edelson, CFA, who, while not an energy expert, provides valuable business guidance which resulted from his numerous Unicorns and 166 board seats throughout his career.

These factors suggest Optima is at the right place at the right time. In the post technology bubble period, or “technology nuclear winter” of 2003-2005, a secular sector bottom was made, and great new technology companies sprouted. Those clear eyed investors who focused on new markets and technologies had the opportunity to invest in Netflix, Facebook, Google, Amazon and Apple—most of which greatly exceeded tenfold returns. A similar opportunity may exist in the energy sector today.

In 2002, I complained to famed investor Leon Levy, that I was trying to rebuild my, heretofore, technology focused investment business. He said, “a bear market is the best time to build a new business.” Why? Assets are cheap, talented experts and executives can be hired at a reasonable prices and opportunity abounds.

Business Momentum and Conclusion:

Optima is finding growing energy private equity and venture capital interest. Last week, Optima signed an agreement with Grind Capital and Precision Procurement Solutions to work with the US military on dual use technology development contracts potentially generating our first revenues in two months.

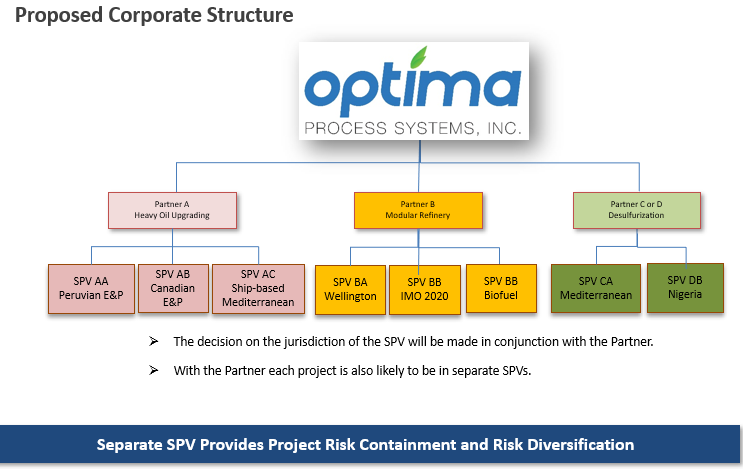

Optima’s Organizational Chart, below, illustrates our current business development objectives:

Optima Process Systems, Inc., supports the UN Sustainable Development Goals. We are working to develop and commercialize the novel process technologies which will bring a cleaner, healthier and brighter tomorrow. It is exciting to work on this epoch environmental challenge; it is especially encouraging to have identified remunerative pilot projects and be gaining traction in this large dynamic market.

Please contact us to learn more about our business plans, pilot projects and investments as well as to include you in the upcoming conference calls.